|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

How to Qualify for Refinance: Expert Tips and AdviceRefinancing your mortgage can lead to better interest rates and improved financial health. Understanding the qualifications needed is crucial for success. Understanding Your Credit ScoreYour credit score plays a significant role in refinancing eligibility. Lenders use it to assess your financial reliability.

Evaluating Your Debt-to-Income RatioLenders examine your debt-to-income (DTI) ratio to determine your ability to manage monthly payments. Calculating Your DTIDivide your total monthly debt payments by your gross monthly income to find your DTI ratio. Improving Your DTI

Gathering Necessary DocumentationHaving the right documents ready can streamline the refinancing process.

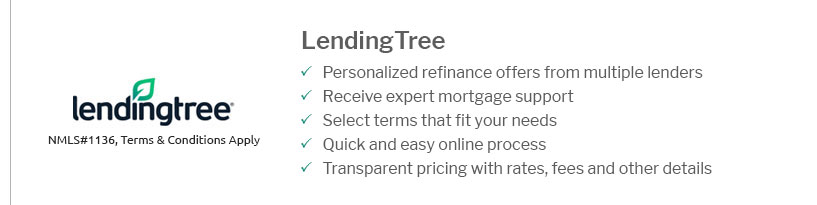

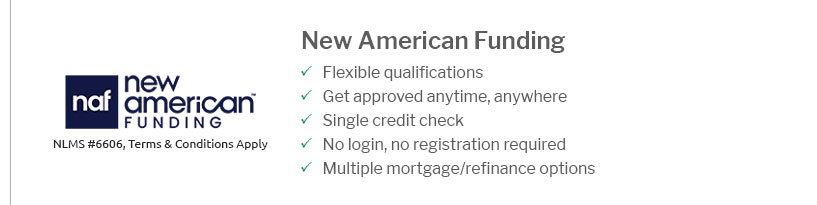

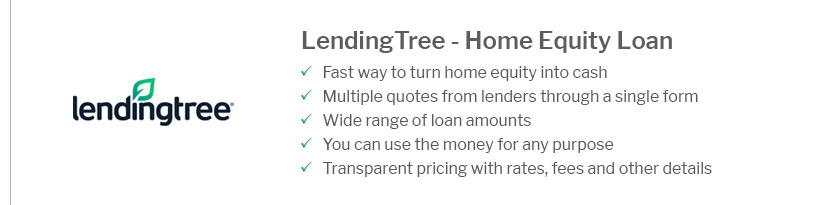

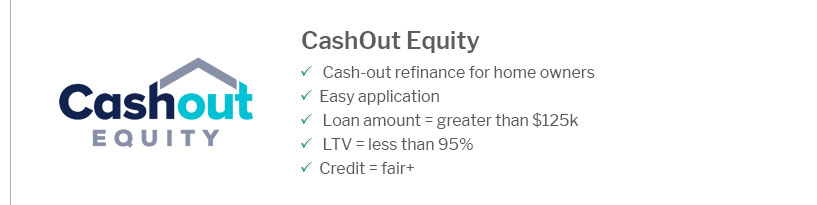

Ensure you have these documents ready to present to lenders. Learn more about current mortgage rates az to stay informed. Choosing the Right LenderSelect a lender that suits your specific needs. If you're a non-traditional worker, explore mortgage lenders for temporary workers to find flexible options. FAQWhat is the minimum credit score needed to refinance?While the minimum credit score varies, most lenders prefer a score of at least 620. How does refinancing affect my credit score?Refinancing can temporarily lower your credit score due to the credit inquiry but may improve it in the long term by reducing your debt. Can I refinance if I have a high DTI ratio?Yes, but it may be more challenging. Consider improving your DTI ratio by paying down debts or increasing your income. https://www.rocketmortgage.com/learn/refinance-mortgage-requirements

In addition to an adequate credit score, you must have built up enough equity in your home to qualify for a refinance. Home equity is the ... https://themortgagereports.com/76288/basic-refinance-requirements

Most lenders look at your credit score, debt-to-income ratio, home equity, and personal finances before underwriting a new mortgage. https://www.quickenloans.com/learn/refinance-requirements

Lenders will look for a strong credit score, consider your debts and how much equity you have in your home among other requirements.

|

|---|